Creating State E-files

Many states employ a procedure in which the State e-file piggybacks on the Federal e-file. If this option is available for your state, you will transmit both the Federal and State returns to the IRS. After the IRS has accepted and processed the Federal e-file, the state e-file is forwarded to the appropriate state-taxing agency.

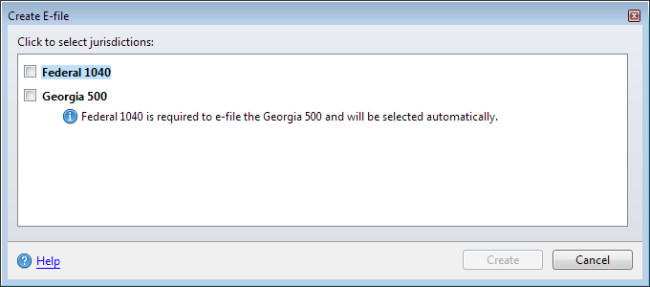

To create linked, unlinked, or direct state e-files:

- Open the return.

- Click the E-file button on the toolbar.

- Select the Federal check box and the check box for the state with which you want to file the return.

If you have errors, you will need to resolve them before you can create the e-file. Refer to the Create E-file Dialog Box topic for specifics on e-file errors.

- Resolve any errors that stand in the way of filing a state return.

- Select the state jurisdiction for which you want to create an e-file.

- If you selected a state that offers multiple types of State e-files, select the type of State e-file you want to create.

- Click Create.

The E-file Creation Results Dialog Box appears.

- Click OK.

- If unsuccessful, make the necessary corrections; then, repeat the e-file creation process.

See Also:

Displaying E-file Rejection Errors or Messages